News

The MYM Creator Landscape: Data-Driven Insights to Watch in 2025

As adult content platforms evolve in 2025, MYM (Meet Your Model) continues to stand out as a leading subscription-based platform for influencers and creators. But what does the data actually reveal about its user base?

We’ve analyzed a dataset of 1,000 MYM creators to uncover patterns around location, pricing, social media presence, content activity, and monetization. Whether you’re a creator looking to grow your profile or a brand scouting influencer opportunities, these insights can guide your strategy.

What Is MYM?

MYM (Meet Your Model) is a European-based subscription platform where creators monetize exclusive content by offering fans access through monthly and bundled subscriptions. Often described as a French alternative to OnlyFans, MYM has gained particular traction in Francophone markets and caters heavily to models, fitness influencers, adult creators, and lifestyle influencers.

Launched in 2019, the platform was designed with a creator-first approach, offering enhanced privacy features (like geoblocking) and options for custom interactions (pay-per-view messages, private media requests, and live shows). Its focus on user security, GDPR compliance, and a strong mobile experience helped it grow steadily in a competitive creator economy.

MYM Growth Over the Years (Estimated)

While exact internal YoY figures are unavailable, various industry reports and publicly tracked metrics suggest:

| Year | Estimated Creators | Platform Growth Highlights |

| 2020 | ~10,000 | Early adoption, France-heavy |

| 2021 | ~25,000 | Surge from pandemic exposure |

| 2022 | ~50,000+ | International expansion begins |

| 2023 | ~75,000+ | Partnerships and events grow |

| 2024 | ~100,000+ | Creator tools & bundles added |

| 2025 | ~120,000+ (est.) | AI caption tools, social CRM |

Estimated YoY Growth Rate (MYM Creators)

| Year Interval | Growth Rate (%) |

| 2020–2021 | 150% |

| 2021–2022 | 100% |

| 2022–2023 | 50% |

| 2023–2024 | 33% |

| 2024–2025 | 20% (projected) |

Overview of the Dataset

- Total Number of Creators Analyzed: 1,000

- Currency Used: EUR (most common and likely default)

- Geographic Spread: Creators are spread across 316 unique locations and at least 12 countries, with a strong concentration in France.

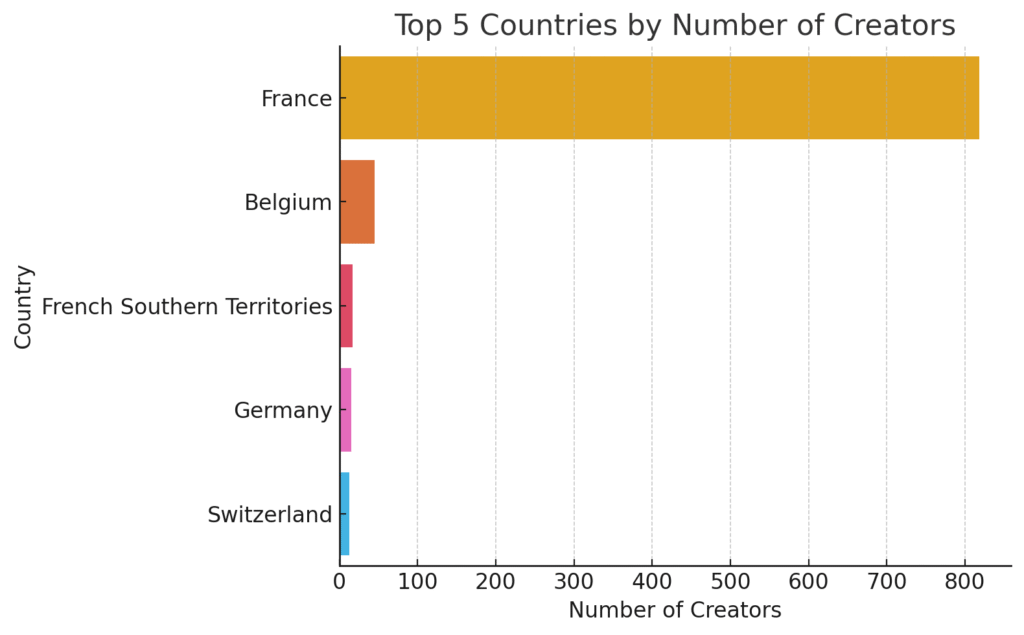

Geographic & Market Insights

- Top Country: France dominates the creator base, accounting for 81.8% (818 out of 1000).

- Other Notable Countries:

- Belgium: 45 creators

- French Southern Territories: 17 (likely VPN routing or user error)

- Germany: 15

- Switzerland: 13

- Belgium: 45 creators

Insight: The MYM platform seems primarily used by French-speaking creators, suggesting regional marketing and outreach efforts could benefit from deeper Francophone localization.

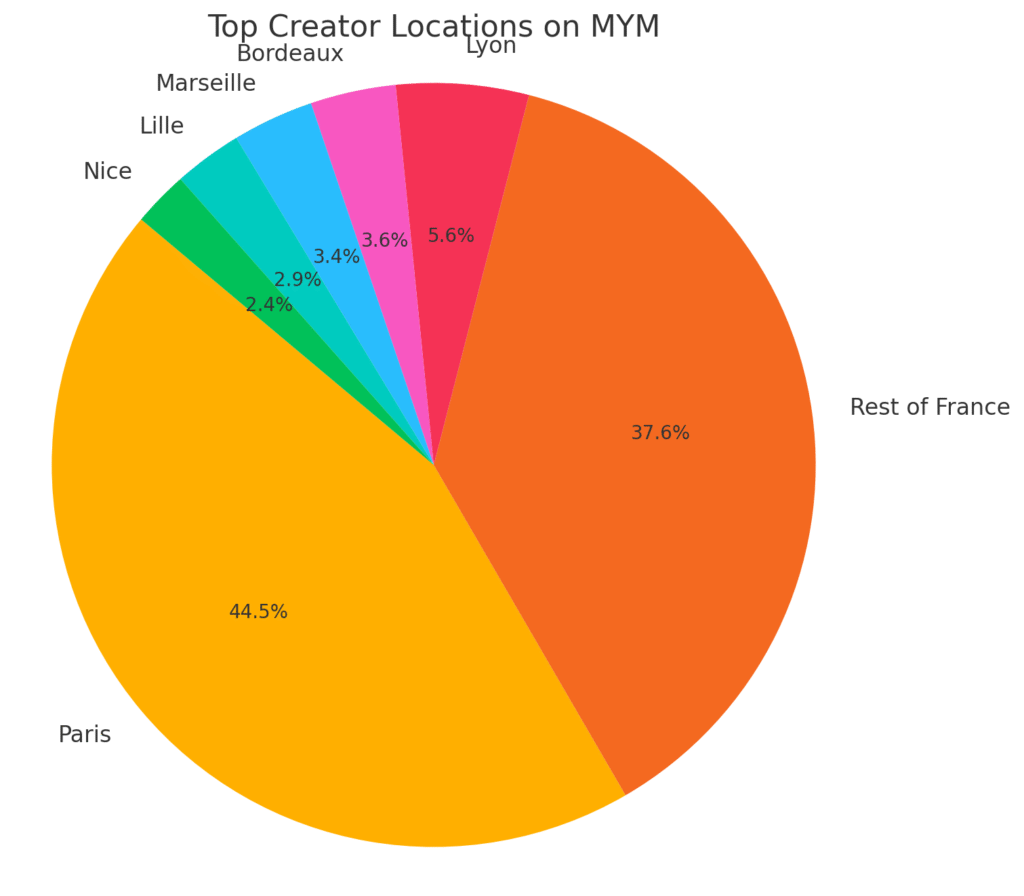

Where Are MYM Creators Based?

One of the strongest trends that emerges is geographical concentration. France alone represents over 80% of the dataset, with Paris accounting for nearly a quarter of all creators.

Top 10 Creator Locations (by share)

| Location | Creator Count | % of Total |

| Paris | 246 | 24.6% |

| France | 148 | 14.8% |

| Lyon | 31 | 3.1% |

| France | 23 | 2.3% |

| france | 20 | 2.0% |

| Bordeaux | 20 | 2.0% |

| Marseille | 19 | 1.9% |

| paris | 17 | 1.7% |

| Lille | 16 | 1.6% |

| Nice | 13 | 1.3% |

Note: Location fields suffer from inconsistent capitalization and redundancy (e.g., “France”, “france”). Once normalized, it’s clear MYM is a French-dominated platform with Paris at its core.

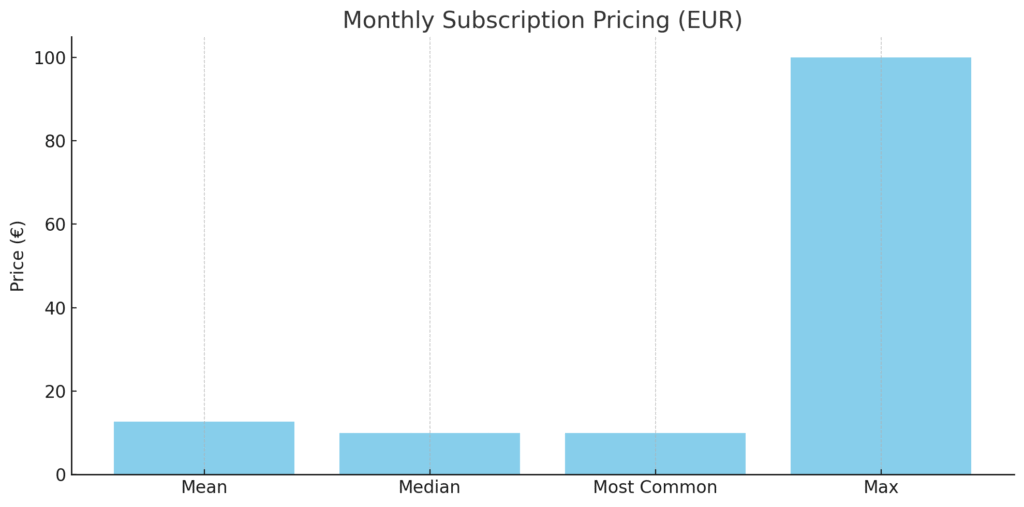

Pricing Strategy: What Are Creators Charging?

Subscription Pricing Behavior

- Average Monthly Subscription Price: €12.64

- Average Semester (6-Month) Subscription Price: €50.61

This implies an effective monthly discount of ~33% when subscribing for a semester — an incentive strategy worth highlighting in UX or marketing.

Insight:

- Price clustering around €9.99, €14.99, and €19.99 suggests standardized pricing behavior.

- Creators may benefit from pricing A/B tests, especially in undercutting €10 psychological thresholds or emphasizing semester discounts.

Monthly Subscription Prices (EUR)

| Metric | Value |

| Mean Price | €12.64 |

| Median Price | €9.99 |

| Most Common | €9.99 |

| Max Price | €99.99 |

Most creators hover around the €9.99 default, likely set by the platform or adopted out of convenience. However, with some users charging up to €99.99, there’s significant room for premium pricing, particularly for highly engaged creators.

Semester Subscription Prices (EUR)

| Metric | Value |

| Mean Price | €50.61 |

| Median Price | €39.99 |

| Max Price | €399.99 |

Semester subscriptions typically offer value bundles, but there are outliers charging extreme premiums, indicating niche success.

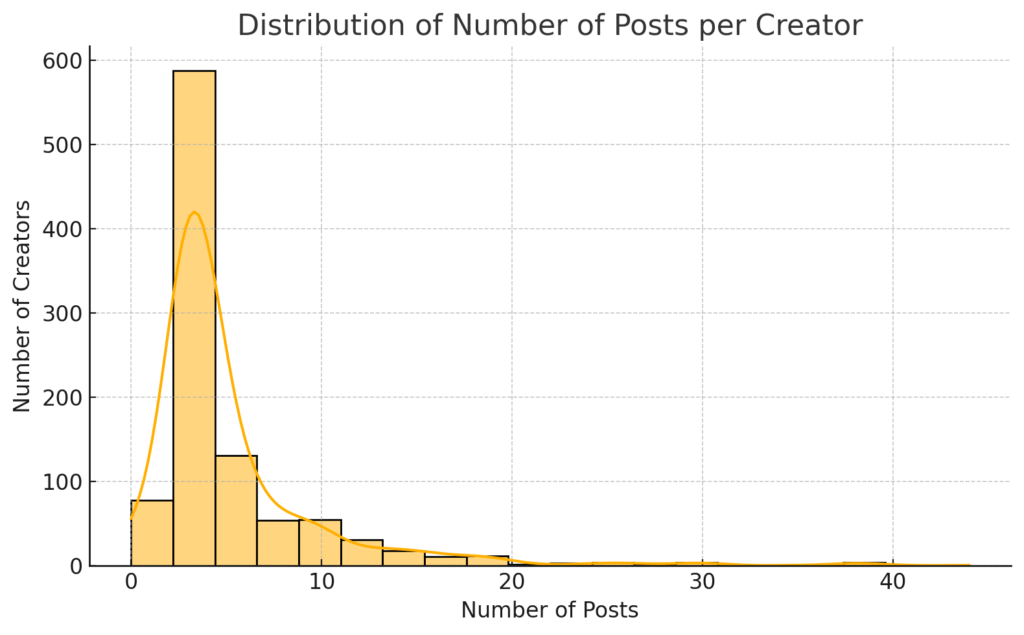

Activity & Engagement: Are Creators Posting Enough?

- Average post count: 5.3

- 75% of creators post fewer than 6 times total

- Max post count: 44

- Average Subscribers: 0

- The “0 subscribers” metric is likely due to:

- API restrictions hiding subscriber counts

- Newly onboarded creators

- Unlaunched or inactive profiles

This shows a sizable portion of creators remain semi-active or dormant. Consistent posting is likely a key differentiator between top earners and passive users

Recently Active Creators

Our filtered data also identified creators who were active (posted or online) after July 15, 2025—ideal candidates for promotions, collaborations, or advanced features.

.Are Creators Leveraging Social Media?

| Platform | Linked Creators |

| 99 | |

| Snapchat | 39 |

| TikTok | 33 |

| 32 |

Fewer than 10% of creators link any social platform. This is a missed opportunity in terms of discoverability and traffic funneling.

Encourage creators to sync profiles on TikTok and Instagram. These channels are still the most powerful external drivers of paid subscription traffic

Profile Completeness

- Profile picture uploaded: 82.7%

- Cover picture uploaded: 35.9%

A strong visual presence correlates with user trust and conversion. Creators should treat profile design as seriously as content creation.

Currency Distribution:

Currency Distribution:

- EUR dominates (likely due to geographic concentration in France).

- There’s almost no diversity in currency usage, reflecting the regional nature of the dataset.

MYM Key Strategic Takeaways

Strategic Recommendations

- Targeted Creator Support in France:

- Offer workshops or micro-influencer campaigns to deepen market share.

- Geo-personalized onboarding flows in French.

- Offer workshops or micro-influencer campaigns to deepen market share.

- Increase Content Volume:

- Launch a “10-post milestone challenge” for new creators.

- Provide content idea templates or AI prompts to reduce creator friction.

- Launch a “10-post milestone challenge” for new creators.

- Subscription Strategy:

- Recommend semester discounts proactively in creator dashboards.

- Highlight benefits of “€9.99 psychological pricing” in guides.

- Recommend semester discounts proactively in creator dashboards.

- Social Linking Optimization:

- Flag creators with no social links for follow-up nudges.

- Offer preview cards for integrated platforms to make linking feel valuable.

- Flag creators with no social links for follow-up nudges.

| Area | Actionable Insight |

| Geo Targeting | Run city-specific campaigns in Paris and Lyon |

| Pricing | Push beyond the €9.99 comfort zone via bundles |

| Content | Creators need to hit >10 posts for real traction |

| Social Integration | Encourage linking of social platforms |

| Activation | Identify dormant creators and re-engage them |

| Aesthetics | Push for full profile customization |

The Road to Monetization Starts with Insights

This data shows MYM has a dominant presence in France, but also highlights huge untapped potential in pricing, content volume, and social cross-promotion.

For creators, the message is clear: consistency, connection, and differentiation are the keys to success.

For brands and platforms, this data opens a path to hyper-targeted outreach, intelligent creator onboarding, and smarter monetization frameworks.

Want deeper access to creator performance data? Reach out to us at OnlyNews.com for full platform analyses, dashboards, and custom insights.